Medical billing companies handle the financial side of healthcare services. They process insurance claims by verifying patient eligibility, coding medical procedures, and then submitting claims to insurers for timely reimbursement to healthcare providers.

For doctors and healthcare teams, the main goal is taking care of patients. But after the appointments and treatments, there’s a big task: getting paid.

That’s where the medical billing business comes in. When you outsource medical billing to experts, they send the bills to insurance companies, making sure providers get the right payment for the services rendered. Such firms handle the paperwork, correct any mistakes, and deal with the insurance details. So, instead of getting bogged down with billing and insurance, providers can focus on providing care to their patients.

In simple terms, while healthcare officials take care of health, medical billing firms take care of the bills. It’s teamwork that makes sure everything at a healthcare practice runs smoothly for everyone.

Role of the Billing Company in Insurance Claims

Handling insurance claims might seem like a straight path, but there’s quite a bit that goes on behind the scenes. Medical billing companies work hard to ensure doctors and healthcare providers are paid correctly and without delays.

Breakdown of Medical Billing Process Step-by-Step

-

Claim Creation

After you see a patient, the billing company makes a claim. This is a detailed bill showing what treatments or services the patient received.

-

Checking the Claim

The insurance company then looks at this claim. They make sure everything matches the patient’s insurance plan and that there are no mistakes.

-

Payment Time

If everything looks good, the insurance company pays up. But sometimes, they might find an issue or need more information. Here’s an interesting fact: the American Medical Association found that about 9% of claims are first rejected by insurance companies. That means the billing company often has to fix and resend some claims.

-

Billing the Patient

The journey doesn’t end once the insurance company pays. Sometimes, there are charges the insurance doesn’t cover, like certain fees, deductibles, or copays. In this situation, the responsibility of the payment shifts to the patient. Here’s when outsourcing medical bills saves you. The billing business ensures that the patient receives a clear, itemized invoice and guides them through the payment process.

Considering all these steps and challenges, it’s easy to see why having a medical billing partner is so important. When you don’t get time to understand and navigate the billing process, billing experts are the only way out, so why wait? We let doctors and healthcare staff focus on taking care of patients, while also making sure everyone gets paid. Fair enough, no?

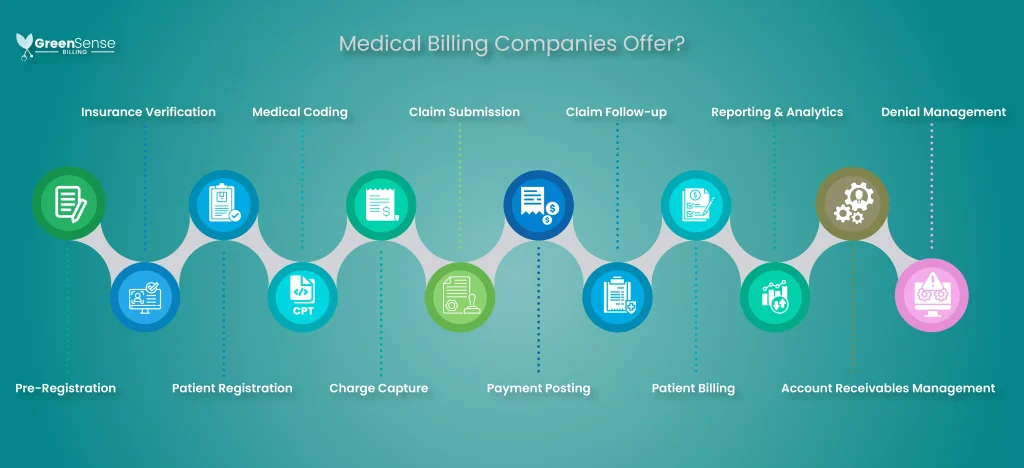

Services Medical Billing Companies Offer?

Medical billing companies are like helpers for doctors and health centers. We do more than just send out bills. From patient Insurance verification to managing finances and payment postings, we ensure smooth operations and complete revenue cycle management for healthcare facilities.

-

Pre-Registration

Even before a patient’s visit, we collect preliminary data, setting up the foundation for the upcoming appointment.

-

Insurance Verification

The designated team now checks the patient’s insurance status, identifying which services are covered, and ensuring there are no unexpected billing issues later.

-

Patient Registration

At the time of the visit, we gather and confirm patient information, making sure all data is accurate and up-to-date.

-

Medical Coding

Most billing companies often serve as a medical coding business. After treatment, trained coders translate the medical services provided into universal medical codes, using systems like ICD-10 or CPT. This coding helps insurance companies understand what treatments were given.

-

Charge Capture

The QA team ensures that every coded service is billed correctly, capturing all charges related to a patient’s visit.

-

Claim Submission

These coded details are then sent to insurance companies as claims. Make sure you choose a company that guarantees that every claim is accurate, minimizing the chances of claim rejections.

-

Payment Posting

When payments are received from insurance companies or patients, we systematically record them.

-

Claim Follow-up

If there’s a hiccup with a claim, like a delay or rejection, we address it, liaising with the insurance company to get it sorted.

-

Patient Billing

Any charges not covered by insurance, such as copays or deductibles, are billed directly to the patient, with clarity and transparency.

-

Reporting & Analytics

We keep healthcare providers informed with regular financial reports, offering insights into their financial health.

-

Account Receivables Management

If there are any overdue payments, we chase them rigorously ensuring that your facility gets the maximum revenue.

-

Denial Management

Happens rarely at GreenSense Billing, but if a claim gets denied, we delve into the cause, rectify it, and resubmit, ensuring every service you provide gets its due payment.

These steps together cover the entirety of RCM. Now you know what do medical billing companies do? We bridge the gap between healthcare services and their financial representation, making sure each service is aptly compensated. If there are any specific aspects of RCM you’re concerned about, please let us know in the comments

How Do We Get Providers Paid?

We track every bill closely, making sure insurance companies respond on time. If they delay or miss a payment, we get deeper into it, following up until you get what’s rightfully yours.

Our collection experts keep calling, asking, and making sure insurance pays what’s due to you. In case of any issues, we quickly sort them out and make sure the claims meet all requirements. You just don’t worry, we never let them forget or avoid your bills.

Because if insurance companies are tough, we’re tougher! 😎

How Do Medical Billing Companies Get Paid?

Here comes the final part for providers who have decided to outsource their medical bills.

Mostly, we get paid in three common ways:

Percentage

Some companies charge a percentage of the total amount collected. For instance, GreenSense Billing. We charge 2.99% of your collections. So if you get paid $1000 from insurance and patient payments, we will earn $29.90.

Flat Fee

Some billing companies also charge a fixed amount for every claim they handle, no matter how much money is involved.

Hourly Rate

You’ll also come across billers who charge based on how many hours they work on your billing tasks.

Choosing a payment method often depends on the size of the healthcare provider and the volume of claims.

Wrap Up

Navigating the maze of medical billing can be a real headache. That’s where teams like ours at GreenSense Billing come in. While you, the healthcare providers, are busy ensuring your patients are in the best health, we’re here to ensure your finances are in top shape. We handle all the nitty-gritty details, from sending bills to insurance companies to ironing out any hiccups along the way. And here’s a little tidbit: about 9 out of every 100 medical bills face initial hiccups with insurance companies. That’s where we roll up our sleeves and dive in!

With GreenSense Billing by your side, you can focus solely on patient care without stressing about medical billing info, knowing your billing is in safe hands. And to show we’re on your team, we’re offering a free billing check-up. Let’s work together to make healthcare smoother and more efficient for all of us!

FAQs

Q: What does a medical billing company do?

A: They process and submit healthcare claims to insurance companies.

Q: How do they ensure claim accuracy?

A: They verify patient eligibility and code medical procedures correctly.

Q: What happens if a claim is rejected?

A: They review, correct, and resubmit the claim to insurers.

Q: Do they handle patient billing too?

A: Yes, they bill patients for uncovered charges like copays.

Q: How do they manage delayed payments?

A: They follow up rigorously with insurance companies for timely payouts.