In the whirlwind world of urgent care, where the door barely shuts before another patient walks in and where the only things multiplying faster than bacteria on a petri dish are patients and paperwork, the flood of patients walking through the door is just the beginning.

It’s a realm where the pace never slows, and the challenges extend far beyond medical emergencies. Here, the battle is twofold: providing top-notch care while navigating the treacherous waters of billing, coding, and reimbursements.

If you’ve ever felt like you’re running a marathon with no finish line in sight, especially when it comes to urgent care RCM and reimbursement, you’re in good company.

This article here is to throw you a lifeline, offering tips to not just stay afloat but to sail ahead in the financial aspect of urgent care.

So, let’s dive in, and see how you can enhance your revenue, ensuring your urgent care center isn’t just surviving, but thriving.

Optimize Billing Processes

The foundation of a financially healthy urgent care center lies in its billing efficiency.

Ensuring that your billing processes are streamlined can significantly reduce errors and delays in reimbursements.

Invest in training your staff on the latest billing codes and regulations. Consider adopting advanced billing software that can automate many of the processes, from patient check-in to insurance verification and billing, reducing errors and speeding up the reimbursement cycle.

Seek External Help

If your team is finding it tough to manage everything by themselves, there’s no harm in seeking additional support.

At GreenSense Billing, we’ve seen many clinics and hospitals who do their own billing but still reach out to us for a bit of extra assistance.

Opting for an outsourced medical billing service brings in an expert who can really lighten the load, especially with tasks like preparing and reviewing claims, tackling rejections, keeping track of outstanding payments, and ensuring that collections are handled smoothly.

It’s all about making sure your financial operations run as smoothly as possible, without overburdening your staff.

Take Advantage of Pre-Authorization

By obtaining approval from insurance companies before providing certain treatments or procedures to your patients, you minimize the risk of denied claims.

This approach ensures that the services you offer are covered, providing peace of mind for both your team and your patients.

It streamlines billing, speeds up reimbursement, and reduces administrative headaches, making it a crucial step for boosting revenue.

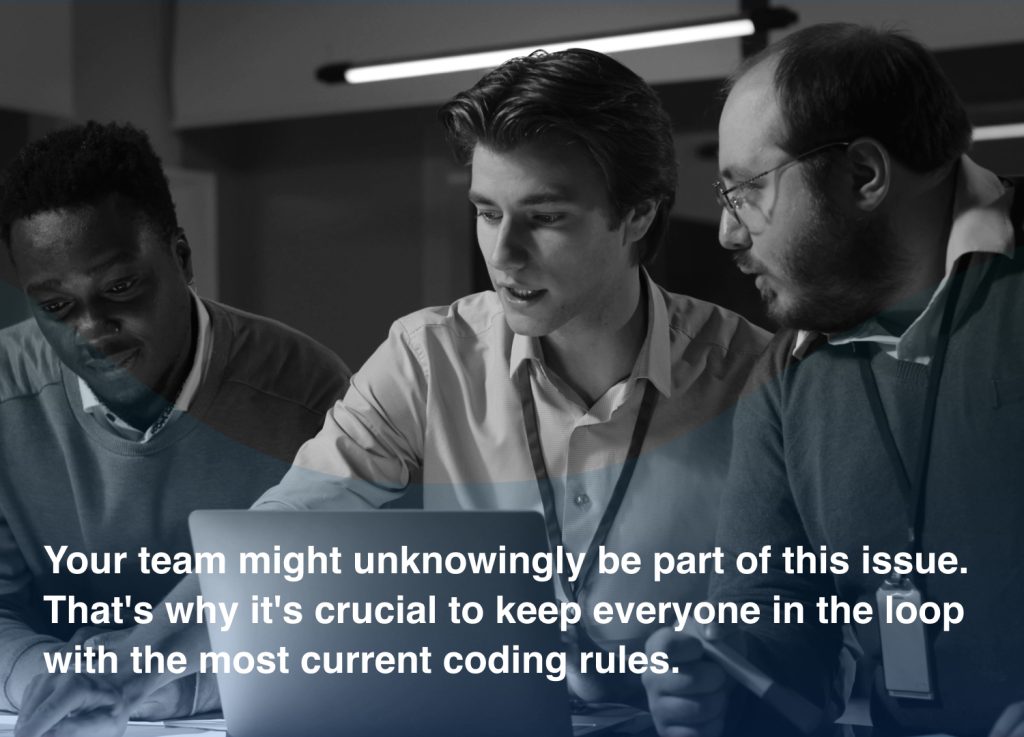

Ensure Coding Accuracy

Recent studies have shown that mistakes in urgent care revenue cycle management can lead to great loss for the US healthcare system annually.

Make sure your team is well-versed in the latest ICD-10 and CPT codes and regularly checks their work.

While it might sound like a big task, staying on top of these details can greatly reduce errors, cut down on rejected claims, and improve your payment rates.

Negotiate Better Payment Rates with Payers

Don’t settle for the first offer insurers throw your way.

We’ve seen too many urgent care providers, just like you, accept less than they deserve.

Take a recent client of ours, who came to us with their revenue cycle in knots. They did a bad job negotiating payers. But what’s shocking isn’t just that their payment rates were stuck, but that other healthcare providers were getting paid 2 to 3 times more by the same insurers for the exact same services and codes.

Imagine providing top-notch care, using the exact same billing codes, and then finding out you’re being paid a fraction of what others are. It’s more than frustrating—it’s downright unfair.

That’s precisely why we champion seeking expert advice.

You went to medical school, not into billing and coding, so it’s easy to miss out on what you could be earning.

Embrace Online Payment System

Introduce an online payment option for your patients and watch how quickly they settle their bills.

Rolling out this option in your clinic is not just an approach to encourage patients to meet their financial obligations but also a great step in modernizing your billing process. This means less hassle for everyone.

For your patients juggling copays and insurance details, it’s a relief. It’s like opening a door to smoother, worry-free transactions, making everyone’s life a bit easier.

Optimize Patient Flow

A smooth patient flow allows you to see more patients without sacrificing care quality.

Look for bottlenecks in your process and implement solutions like online scheduling and efficient check-in procedures to keep things moving.

This approach also plays a crucial role in patient satisfaction and satisfied patients are likely to return and refer others.

Ensure every interaction, from reception to care, is positive. High satisfaction scores can also strengthen your position in negotiations with payers.

Review End-of-Month Reports

Make sure to create and go over end-of-month reports. It’s important for your business to use a professional healthcare billing software that lets you generate these reports regularly.

These reports will give you a detailed view of your finances and an update on any outstanding payments you’re owed. They can also highlight trends based on different financial categories, which might point out issues with how much you’re getting paid.

This practice is key to keeping a healthy pulse on your business’s financial health and identifying any potential problems early on.

End Note

As we wrap up this guide, remember, navigating the financial waters of urgent care doesn’t have to be as daunting as a Monday morning without coffee. With these strategies in your toolkit, you’re well on your way to turning those financial frowns upside down.

Keep your billing processes slick, your coding accurate, and don’t forget to charm those payers into better rates. And when the going gets tough, remember, there’s always a way to make those numbers dance in your favor.

Here’s to less stress over spreadsheets and more cheers for a healthier bottom line!