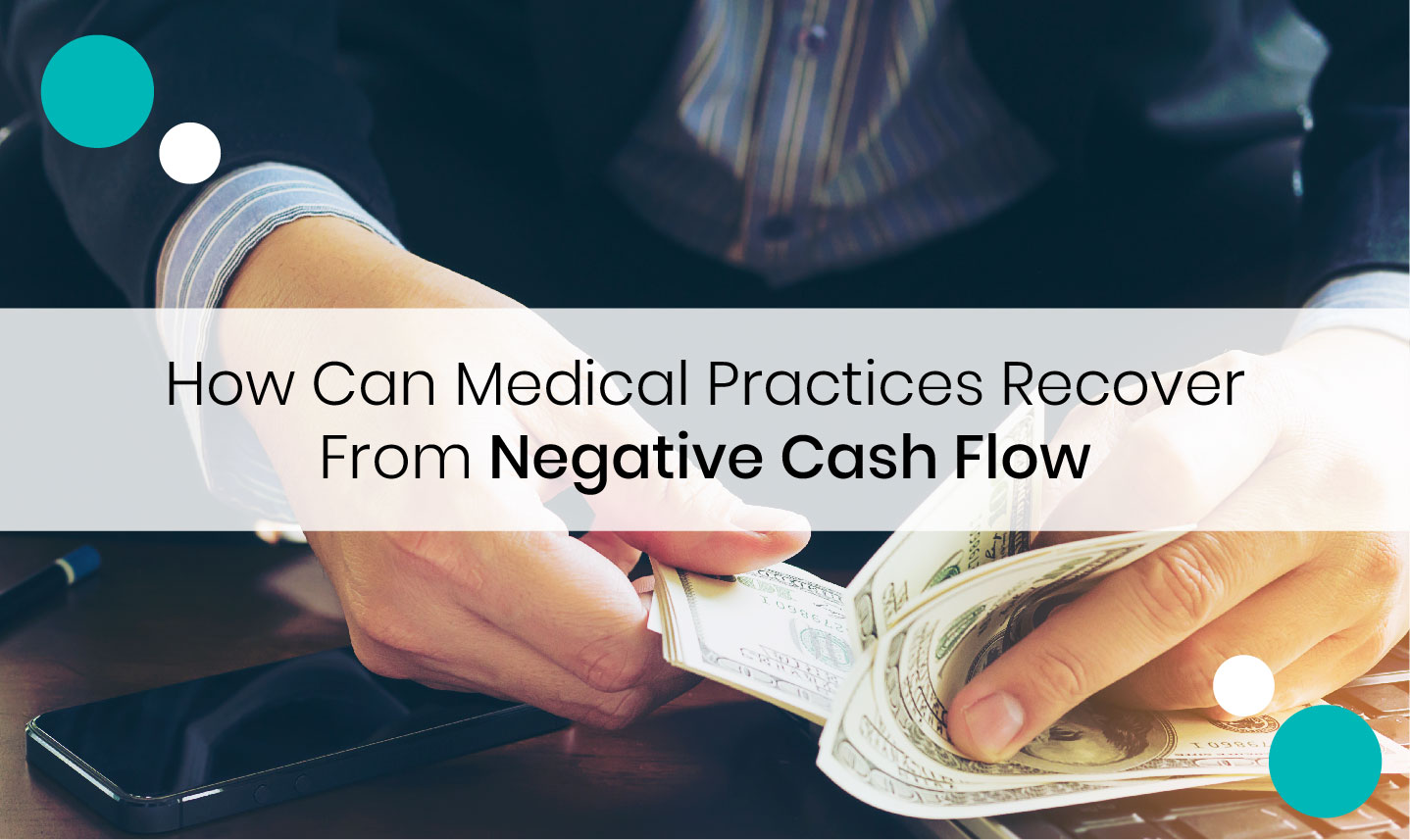

A positive or negative cash flow is one of the best and most crucial indicators of the overall financial health of any medical practice. If accounts receivable of your practice seem to be at a reasonable number, you or your billing team are probably doing a good job running your practice and implementing the best ways to improve cash flow.

At the same time, collecting payments owed has become tougher than ever, and it is what affects cash flow. The strategies that worked for a medical service provider in the past may not be effective in today’s era, and small practices are looking for solutions for how to prevent cash shortages. According to research, every one in three Americans has active collections in an account across all businesses.

Overall, last year’s recovery rate was 14.6 percent for medical practices that use collection agencies for their recoveries.

ALSO READ: Best Medical Billing Software for Home-based Practice

Well, negative cash flow is a matter of concern, and every practice has been facing the issue since Covid-19 has hit the world. Doctors are struggling to keep the revenue cycle management in their favor, and that’s where they need to learn good strategies to get back on track.

Here are some tips and techniques we are recommending as the best ways to improve cash flow. Put these methods into action to increase collections and opt-out of negative cash on balance sheet.

Create a proper credit policy.

Your credit policy should be clear and to the point and explained to the patients at the appointment time. You can charge fixed penalty amounts for broken appointments and apply late fee charges on past-due amounts.

Be consistent with your payment policies.

Negative cash flow from operating activities is inevitable. If you are practicing in a group medical facility or practice, apply the same policies across all practices, and all doctors must adhere to them.

Keep your statements clean.

Negative accounts receivable on the cash flow statement should not be mentioned. Never on your forms put the aging information like the amounts past due 30, 60, or 90 days. Also, do not leave a blank box for any amount paid. Always indicate the exact payment amount which is due.

Talk with patients straightforwardly.

One of the examples of cash flow problems is a lack of communication. Never ask your patients, “How much can you pay?” It indicates that your practice can give them relaxation when it comes to paying in full for the services you have provided. Always clarify before treatment how patients are going to pay. And if there is any pending amount, ask them to clear it right today.

Understand negative cash flow from assets.

Your assets are depreciating every day. Cash flow problems in a small business can happen at any time. That is why it is imperative to understand it and design the strategies to get your cash flow graph steep.

Watch out for collection companies.

Collection companies give attention to clients with more significant billing amounts and more the billing tasks with recent balances. This will eventually lead to inactivity on your billing works and account receivables, especially when you submit a lot of low balances and old claims.

Demand compliance from collection agencies.

Always demand compliance from collection companies through tough questions. Always confirm where the collection agency stands regarding compliance and regulations and request the appropriate documentation.

Emphasize on best services instead of recovery rates.

Some practices lure themselves when it comes to the low percentage offered by collection agencies for recoveries, leading to poor services. A meager percentage of recoveries often discourages a collection agency from working enthusiastically on your accounts. Focus on best services instead of on recovery rates.

ALSO READ: How to Know the Right Outsourcing Medical Billing Company For Your Medical Practice

Ask crucial questions.

While hiring for an outsourced service for your collections, don’t hesitate to ask questions that are necessary like:

- Does the collection agency offers tiered pricing or a strict percentage arrangement?

- Will they provide you with robust reporting quarterly, biannually, or annually?

- Does the collection agency have automated tools and software for billing or have an online portal or interface?

- Does the collection agency have expertise in healthcare collections, revenue cycle management, and lien collections?

Conclusion

Clinics often don’t realize how can free cash flow be negative? But its true that various medical practitioners are facing the issue with intense gravity. That is why it is necessary to keep an eye on negative cash flows and know their reasons. The best way to avoid cash flow problems is to practice what we have stated above. Moreover, you can always contact GreenSense Billing to resolve issues regarding your revenue cycle and maintain practice cash flow. We cater to practices in every manner regarding financial health at reasonable prices.